ZA KSD TVET College Registration Form 2022-2026 free printable template

Show details

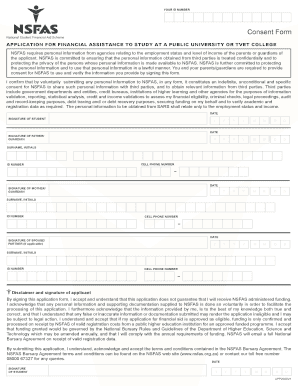

SD VET COLLEGE APPLICATION FORM Please complete the entire form in print & black ink. Mark with an X where applicable. MARATHA CAMPUSENGCOBO CAMPUSMNGAZI CAMPUSNTABOZUKO CAMPUSZIMBANE CAMPUSLIBODECAMPUSMAPUZI

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ksd tvet college online application form

Edit your ksd college online application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application form for tvet college form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing zimbane college online application online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ksd tvet college form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ZA KSD TVET College Registration Form Form Versions

Version

Form Popularity

Fillable & printabley

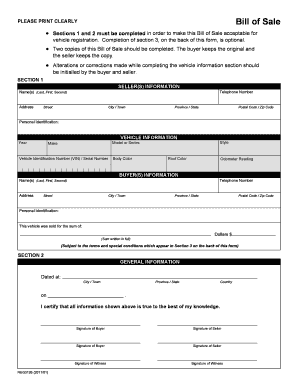

How to fill out to apply you will have copy of proof of residence form

How to fill out ZA KSD TVET College Registration Form

01

Obtain the ZA KSD TVET College Registration Form from the college website or admission office.

02

Fill in personal details including your full name, date of birth, and ID number.

03

Select the course or program you wish to register for from the available options.

04

Provide your contact information, including your phone number and email address.

05

Attach any required documents such as previous academic certificates or identity verification.

06

Review the form for accuracy and completeness before submitting.

07

Submit the completed form either online or by delivering it to the college admissions office.

Who needs ZA KSD TVET College Registration Form?

01

Prospective students who wish to enroll in courses at ZA KSD TVET College.

02

Individuals seeking vocational training or further education in technical and vocational fields.

Fill

ksd student portal

: Try Risk Free

People Also Ask about ksd application status check

Is KSD still open for applications 2022?

The online application for the 2023 academic season for King Sabata Dalindyebo Tvet College will be open from the 1st of September 2022 and it will be closing on the 30th of September 2022.

Is KSD open for 2023?

Applications to study at King Sabata Dalindyebo TVET College in the 2023 academic year are now open. King Sabata Dalindyebo TVET College is located in the Eastern Region of the Eastern Cape Province. King Sabata Dalindyebo TVET College has now opened it's 2023 applications.

Is TVET application open for 2023?

Applications to study at Ekurhuleni East TVET College in the 2023 academic year have now been opened. Ekurhuleni East TVET College is located in Gauteng and is one of the country's 50 public Colleges. 2023 applications to study at Ekurhuleni East TVET College are now open.

Is KSD still open for applications?

The King Sabata Dalindyebo TVET College online application 2023 is open to all interested applicants irrespective of colour, race-ethnic identity, religion, gender, or national origin, provided the quality for the programme for which they have applied.

How can I apply for TVET college Online 2023?

To apply you will have to head to your chosen college's website and complete and submit an online application via a link.TVET Colleges Now Taking 2023 Applications Certified copy of ID. Certified copy of a statement of results. Certified copy of Proof of Residence. Certified copy of Parent/Guardian's ID.

Is KSD still open for applications 2023?

Applications to study at King Sabata Dalindyebo TVET College in the 2023 academic year are now open. King Sabata Dalindyebo TVET College is located in the Eastern Region of the Eastern Cape Province. King Sabata Dalindyebo TVET College has now opened it's 2023 applications.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tvet college registration form online?

Easy online ksd college completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an eSignature for the online application in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your cicirha online applications right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit student portal ksd status check online on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute ksd application form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is ZA KSD TVET College Registration Form?

The ZA KSD TVET College Registration Form is a document that prospective students fill out to apply for admission to the college, providing essential information required for enrollment.

Who is required to file ZA KSD TVET College Registration Form?

All prospective students seeking admission to ZA KSD TVET College are required to file the registration form.

How to fill out ZA KSD TVET College Registration Form?

To fill out the ZA KSD TVET College Registration Form, applicants must provide personal information, academic history, and any relevant supporting documents as specified in the form's instructions.

What is the purpose of ZA KSD TVET College Registration Form?

The purpose of the ZA KSD TVET College Registration Form is to collect necessary information from applicants to facilitate the admission process into the college.

What information must be reported on ZA KSD TVET College Registration Form?

The ZA KSD TVET College Registration Form requires information such as the applicant's name, contact details, educational background, course selection, and any other relevant personal data.

Fill out your ZA KSD TVET College Registration Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Online Application 2025 is not the form you're looking for?Search for another form here.

Keywords relevant to apply online at ksd tvet college

Related to ksd

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.